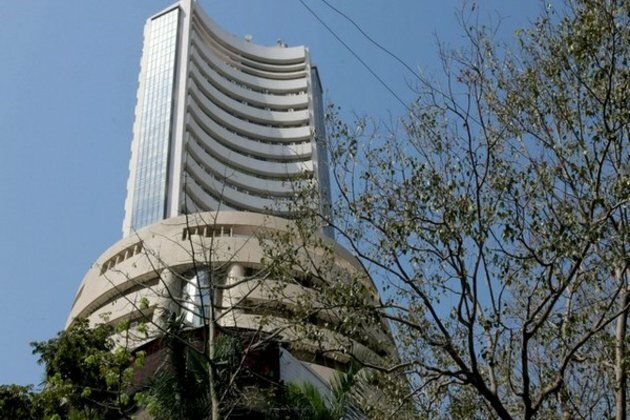

Sensex, Nifty snap 5-day rally; TCS, Infosys rise

ANI

14 Jan 2022, 16:57 GMT+10

Mumbai [India], January 14 (ANI): Snapping five days of rally, the Indian equities markets benchmark Sensex and Nifty closed in the red on Friday due to selling pressure in FMCG and some banking stocks.

The 30 stock SP Sensex of the Bombay Stock Exchange closed at 61,223.03 points, which is 12.27 points or 0.02 per cent down from its previous day's close at 61,235.30 points.

The Sensex closed in the red after a volatile session. The benchmark Sensex opened sharply down at 61,040.32 points and slumped to a low of 60,757.03 points.

The benchmark Sensex briefly soared in the positive touching a high of 61,324.59 points in the intra-day.

The broader Nifty 50 of the National Stock Exchange closed at 18,255.75 points, which is 0.01 per cent or 2.05 points down from its previous day's close at 18,257.80 points.

The Nifty touched a low of 18,119.65 points and high of 18,286.95 points in the intra-day.

There was selling pressure in banking stocks. Axis Bank slumped 2.54 per cent to Rs 721.60. IndusInd Bank fell 0.78 per cent to Rs 920.15; ICICI Bank dropped 0.67 per cent to Rs 818.90 and State Bank of India closed 0.60 per cent down at Rs 508.25.

Asian Paints 2.66 per cent down at Rs 3364.80; Hindustan Unilever 2.13 per cent down at Rs 2364.50; MahindraMahindra 1.61 per cent down at Rs 880.95; Wipro 1.55 per cent down at Rs 639.80; HDFC 1.52 per cent down at Rs 2713.55 and Bharti Airtel 1.48 per cent down at Rs 720.70 were among the major Sensex losers.

There was good buying support in IT stocks. TCS surged 1.84 per cent to Rs 3969.25. Infosys soared 1.64 per cent to Rs 1928.20. Tech Mahindra jumped 1.18 per cent to Rs 1739.25 and HCL Technologies rose 0.32 per cent to Rs 1337.55.

Other major Sensex gainers were: LT 1.32 per cent higher at Rs 2044.75; HDFC Bank 1.11 per cent higher at Rs 1545.25; UltraTech Cement 0.60 per cent higher at Rs 7655.25; Kotak Bank 0.54 per cent higher at Rs 1937.15 and NTPC 0.30 per cent higher at Rs 135.35. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Central Coast News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Central Coast News.

More InformationBusiness

SectionFTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

California

SectionU.S. Treasury Secretary says Musk should steer clear of politics

WASHINGTON, D.C.: Elon Musk's entry into the political arena is drawing pushback from top U.S. officials and investors, as his decision...

TikTok building U.S.-only app amid pressure to finalise sale

CULVER CITY, California: TikTok is preparing to roll out a separate version of its app for U.S. users, as efforts to secure a sale...

D.C. United take on Galaxy in first match under interim coach

(Photo credit: Steve Roberts-Imagn Images) Troy Lesesne paid the price for D.C. United's lackluster season and academy director Kevin...

Minnesota hosts San Jose in key Western Conference showdown

(Photo credit: Matt Blewett-Imagn Images) Two teams coming off grueling midweek U.S. Open Cup matches face off Saturday when the...

Facing suspension, Jake Retzlaff withdraws from BYU

(Photo credit: Mark J. Rebilas-Imagn Images) Embattled quarterback Jake Retzlaff announced Friday that he is withdrawing from BYU,...

Valkyries to put 'disruptive' defense up against Aces

(Photo credit: Trevor Ruszkowski-Imagn Images) The Golden State Valkyries cap off their four-game road trip at the Las Vegas Aces...